Over several decades, the microfinance sector has experienced an undeniable expansion. The maturity of this sector and its increasing financialisaton, together with the “technological boom” in developing countries, have pushed international solidarity organisations to reposition themselves by proposing new methods of intervention.

On 4 February last, at an event organised by GRET, microfinance experts met to discuss the way in which evolutions and trends in the inclusive finance sector have influenced French and European international solidarity organisations’ mode of operations in recent years.

Supported by its scientific department, GRET’s microfinance experts brought together approximately forty practitioners working with technical operators, engineering consultants, donors and investment funds or foundations in GRET’s offices at the Sustainable development campus on the outskirts of Paris

Experts in agriculture and green energy were also in attendance to put the issues of microfinance discussed into perspective. Apart from creating a forum within which to take a step back and engage in peer discussions, this first edition aimed to improve GRET’s strategic exercise and share it with practitioners present from a forward-looking perspective.

The discussions that took place over the day were compiled in a recent publication in GRET’s Débats & Controverses series, the content of which alternates between feedback on round table discussions and a summary of discussions.

What commitments have donors made in favour of financial inclusion?

The contribution of CGAP (Consultative Group to Assist the Poor), whose action-oriented research work enables a more transversal vision of the sector, focused on evolutions in funding. CGAP identified various trends characterising the microfinance sector today:

- Constant increase of public commitments, in particulier national and international institutions funding development, which have increased by 54 % since 2011, reaching almost 40 million euros in 2017. We can observe that 70 % of investments come from the public sector.

- Diversification of financial services providers, with an evolution in their economic model due to the different breakdown of financial fluxes, in particular with digital finance. We also note a decrease in the share of funding allocated to governments.

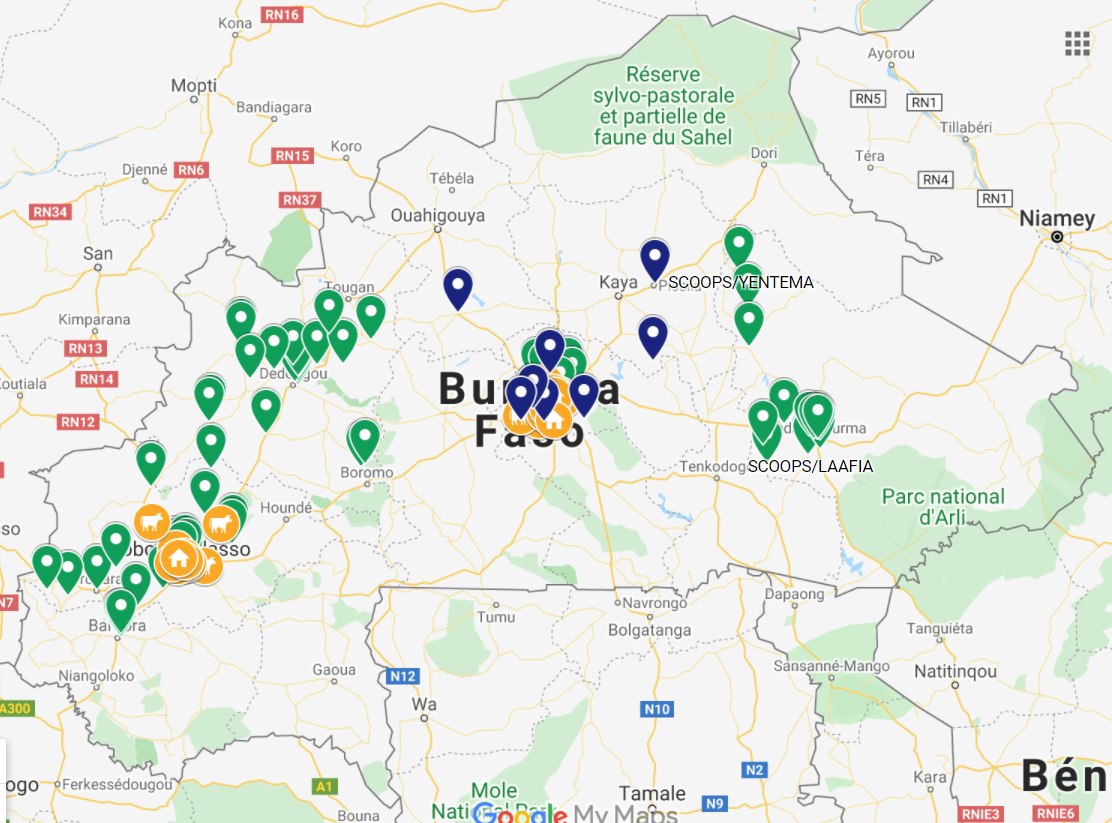

- A change in the sector’s geographic or even geopolitical priority, in particular with first precedence given to development of the market in Sub-Saharan Africa and Southern Asia, where levels of financial inclusion remain low and poverty levels remain high.

- Evolution of financial instruments, with maintenance of the debt instrument and a decrease in grants, the reason for which is as yet hypothetical (projects coming to an end, grants aimed at the poorest countries, amounts of the latter being lower).

So, international aid is evolving. Microfinance has evolved from a traditional concept, whereby it consisted of fighting against poverty of households, to a broader, more inclusive vision. Microfinance is now an intervention methodology and a transversal tool that can be used to tackle more global development issues that are vectors for job creation and reducing migration.

Which operating procedures for international solidarity organisations?

International solidarity organisations such as Iram, Pamiga, Entrepreneurs du Monde, Ada and GRET all spoke at this one-day event. They talked about their commitments and the strategic changes launched in recent years to respond to the new challenges of microfinance and continue playing a role in this sector.

However, a question arises as to the solidity of these organisations. Are they sufficiently structured to maintain inclusive finance activities? Several prospects exists:

- The first consists of defining alternatives to commercial cases, taking an action-research approach. This would consist of seeking new effective solutions for populations currently without services, launching gradual experiments using models that could subsequently be backed by governments, or initiating advocacy on subjects forgotten by agencies and governments, with inclusive finance as a lever for getting out of crisis (refugee camps for example).

- The second consists of adapting to inclusive finance and considering it as a tool for the development of certain sectors. It is a vector and a tool for contribution to sustainable agriculture, to energy transition, professional integration, business creation, etc.

- Finally, the last area envisaged concerns digital finance. Now essential without being an end in itself, it would enable the sector to evolve and facilitate achievement of the sustainable development goals (SDGs), make it possible to cover rural populations and open up new service solutions to complement other models. The context is marked by competition attracting new stakeholders such as mobile phone operators, which strengthen their market logic while at the same time having strong investment capacities. They can potentially occupy a dominant position in digital financial services, without however providing quality and proximity with the service. Financial inclusion (broadening access to banking services) will not necessarily mean inclusive finance (making clients autonomous). International solidarity organisations, in particular via their proximity to real needs, have a role to play in the balance of power for vulnerable populations.